Answer:

Steve should place $6,250 in the 5-year CD and $18,750 in the corporate bond

Explanation:

System of Equations

We need to find how Steve will distribute his investments between two possible options: one of them will pay 5% per annum and the other will pay 9% per annum. We know Steve has $25,000 to invest and wants to have an overall annual rate of return of 8%.

Let's call x to the amount Steve will invest in the CD paying 5% per annum and y to the amount he will invest in a corporate bond paying 9% per annum.

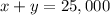

The total investment is $25,000 which leads to the first equation

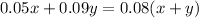

If x dollars are invested at 5%, then the interest return is 0.05x. Similarly, y dollars at 9% return 0.09y. The overall return is 8% on the total investment, thus

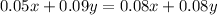

Rearranging:

Simplifying

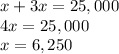

Multiplying by 100

Substituting in the first equation

And therefore

Steve should place $6,250 in the 5-year CD and $18,750 in the corporate bond