Answer:

Part A:

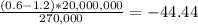

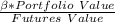

Number of contracts=

Number of contracts=88.889≅ 89 contracts.

The hedge that minimizes risk is to short 88 contracts

Part B:

Number of contracts=

Number of contracts≅-44

The company should short 44 futures contracts.

Step-by-step explanation:

Part A:

The formula we are going to use is:

Number of contracts=

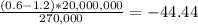

Future Value=Index futures*Multiplier

Future Value=1080*$250

Future Value=$270,000

Number of contracts=

Number of contracts=88.889≅ 89 contracts.

The hedge that minimizes risk is to short 88 contracts

Part B:

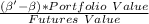

Number of contracts=

where:

is the new value=0.6

is the new value=0.6

=1.2

=1.2

Future Value=$270,000 (Calculated above)

Number of contracts=

Number of contracts≅-44

The company should short 44 futures contracts