Answer:

1) $45

2) 0.2 or 20%

3) BEP units: 7,200

4) BEP dolars 1,620,000

Step-by-step explanation:

225 sales revenues - 180 variable cost = 45 margin per unit

contribution margin ratio:

margin per unit / sales revenue per unit

45 / 225 = 0.2

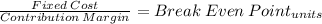

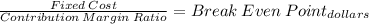

break even:

324,000 / 45 = 7,200 units

342,000 / 0.2 = 1,620,000