Answer:

a)

Total $483,841.9681

b)

cash 483,842 debit

discount on BP 16,158 debit

Bonds Payable 500,000 credit

c)

attached the schedule

d)

interest expense 24,192.1 debit

discount on BP 1,692.1 credit

cash 22,500 credit

e)

interest expense 24276.7 debit

discount on BP 1776.7 credit

cash 22500 credit

Step-by-step explanation:

The price of the bonds is the present valeu of the maturity and coupon payment at the market rate:

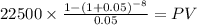

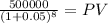

Coupon payment:

22,500.000 (500,000 x 9% /2 )

time 8 (4 years x 2 payment per year)

rate 0.05 (10% / 2)

PV $145,422.2871

Maturity 500,000.00

time 8.00

rate 0.05

PV 338,419.68

PV c $145,422.2871

PV m $338,419.6810

Total $483,841.9681

We compare against face valeu to deteminate wether is premium or discount.

procceds 483,842

face value 500,000

discount on bonds payable -16,158

As lower it is a discount.

For the interst we calcualte doing market rate times carrying value at the time given.

then we subtract the cash outlay and the difference is the amortization in the discounts