Answer:

The bonds now is being traded at $758.63

Step-by-step explanation:

We have to discount the coupon payment and maturity at he market rate:

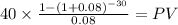

Present value of the coupon payment

Coupon payment $1,000 x 8%/2 = 40.00

time 15 years x 2 = 30

rate 0.08

PV $450.3113

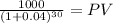

Present value of the maturity:

Maturity $1,000

time 30

rate 0.04

PV 308.3187

PV c $450.3113

PV m $308.3187

Total $758.6300