Answer:

Present value = $115,278.17

Step-by-step explanation:

Given data:

Monthly repay amount for 2 year = $2500

Monthly repay amount for another 2 year = $3500

APR =6%

monthly interest rate = 6.50/12 = 0.54167%

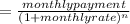

Present value is calculated as

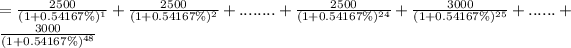

Present value

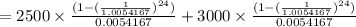

Present value

Present value

Present value = $115,278.17