Answer:

longer bonds will be more sensitive to change in interest rate as their cash flow are mor exposed to interest related to short.term bonds. Notice the PV of the maturiry values for each one to notice the greater difference.

3-year bonds $ 910.16

20-year bonds: $ 762.85

Step-by-step explanation:

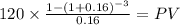

3-years bonds if rate increase to 16% then:

PV of the coupon payment

C 120.00

time 3

rate 0.16

PV $269.5067

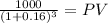

PV of maturity

Maturity $1,000.0000

time 3

rate 0.16000

PV 640.6577

PV c $269.5067

PV m $640.6577

Total $910.1644

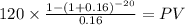

20-years bonds:

C 120.00

time 20

rate 0.16

PV $711.4609

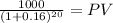

Maturity $1,000.0000

time 20.00

rate 0.16000

PV 51.3855

PV c $711.4609

PV m $51.3855

Total $762.8464