Answer:

- 1. The expansion is not a good investment because the price of the share will decrease.

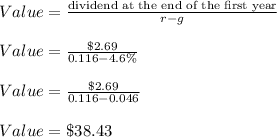

- 2. The new price for Cooperton's stock will be $38.43 per share.

Step-by-step explanation:

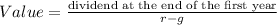

To calculate the share price you would expect after the announcement, you must use the formula for the value of the stock when the dividends are expected to grow at a constant rate g and the expected rate of return is r.

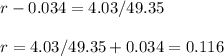

After the announcement, Cooperton's dividends are $2.69 per share and are expected to grow at a 4.6 % rate.

You are only missing the rate of return, r.

Since you assume that the new expansion does not change Cooperton's risk, the rate of return is the same.

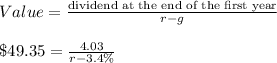

You can calculate the rate of return from the ifnormation priot to the announcement: dividends of $4.03 per share, expected to grow at a 3.4% rate, and share price was $49.35.

Thus, use the same formula quoted above to solve for r.

Rate of return

Now use r = 0.116 for the new dividends.

New price

Therefore, the new price is expected to fall from $49.35 per share to $38.43 per share, so this is not a good investment.