Answer:

the lease payment will be for 130,538.92 dollars

Step-by-step explanation:

as we want a net return of 16%

we will charge 40% to the interest rate to know the nominal interest:

0.16 x 1.4 = 0.224 = 22.4% before-tax rate

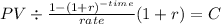

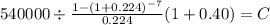

Now, we solve for the lease payment of this annuity-due:

PV $540,000.00

time 7

rate 0.224

C $ 130,538.923