Answer:

Step-by-step explanation:

The formula for calculating the Monthly payments P for the sinking fund is as follows:

where,

P = Monthly payments to be made

A = Total amount to be accumulated

i = Interest rate for given time period

n = Number of time period

Assuming interest is applied at the beginning of each period.

We are given two scenarios.

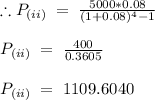

Scenario (i) - Deposit is made during the year:

In this scenario, as some of the year is already passed (assume 6 months), to complete the time period of 3.5 years the interest will compound 3 times (as the 0.5 year payments can be adjusted in the remaining part of the first year and no interest is applied on it). Hence, the interest will be applied 3 times.

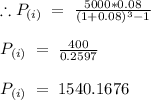

Scenario (ii) - Deposit is made at the beginning of the year:

For this case, the interest will be applied 4 times to complete the time period of 3.5 years for payment.