Answer:

Equipment 255,667 debit

Lease Liability 255,667 credit

Step-by-step explanation:

The company will post the equiptment int accounting as the same value of the discounted lease payment.

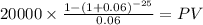

C 20,000

time 25

rate 0.06

PV $255,667.1232

On each year-end the company will recognize the interest expense and the payment of 20,000 dollars

By the end of the lease, there will be no lease liability as all payment were made