Answer:

yes, thepresent value fo the furnite investment is above their cost.

Step-by-step explanation:

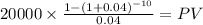

We calculate the present value of the annuity cosnidering the real rate of 4%

C 20,000.00

time 10 years

rate 0.04

PV $240,122.1425

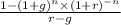

We could also consider this a growing annuity as we are told that the furnitures prices kept the pace with inflation thus growing at 3% per year

and discount at 7% to know how much can we do:

g 0.03

r 0.07

C 20,600 (the first year we receive 20,000 x 1.03)

n 10

Future value: 320,966.01

Present value:

FV/1.07^10 = 163,162.85

This approach yield 7% and is still above the 140 rquired investment thus, we should consider to approve the investment.