Answer:

The second alternative capitalized cost is lower thus, it is convient to go for the half-capacity tanks.

Step-by-step explanation:

Full capacity net worth:

556,000 tunnel investment

+ present value of maintenance cost at perpetuity:

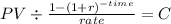

PV $40,000.00

time 10

rate 0.07

C $ 2,895.100

This will be the annual cost for the maintenance as it is every 10 year we calcualte the perpetuity which gneerates this amount:

$2,895.1 / 0.07 = $41,358.57

Total cost: 556,000 + 41,358.57 = 597,358.57

Now, we solve for the cost of the half-capacity. As we already know the value of the first alternative our analisys should stop if we surpass it.

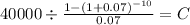

402,000

+ PV of the second

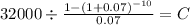

Maturity $402,000.0000

time 20.00

rate 0.07

PV 103,884.44

Then, maintencance cost:

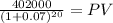

PV $32,000.00

time 10

rate 0.07

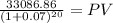

C $ 2,316.080

$33,086.86 for the first one

the second pool will start withdrawals in 20 years so:

Maturity $33,086.8600

time 20.00

rate 0.07

PV 8,550.27

Then, we have a perpetuity of 2,000 dollar for additional pumping cost

on each one:

2,000/0.07 = 28,571.43

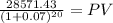

the second again is discounted for 20 years:

Maturity $28,571.4300

time 20.00

rate 0.07

PV 7,383.40

capitalized cost for the second alternative:

402,000 + 103,884.44

+ 33,086.86 + 8,550.27

+ 28,571.45 + 7,383.4

Total capitalized cost: 583,476.42