Answer:

21.11176754

Step-by-step explanation:

storate cost: 0.30

as the storage is continusly we use continuos interest rate:

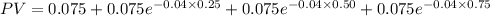

0.30 / 4 = 0.075 per quarter

this is paid in advance so we calculate the present values of this payment

PV = 0.295552053

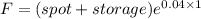

Now we solve for the future value of silver using also a continuos rate

(20 + 0.295552053)e^0.04 = 21.11176754