Answer:

a) $12

b) 804,000 allocate overhead

c) actual overhead 657,000

the overhead was overapplied for 147,000 dollars

d) the job were overcosted as the manufacturing cost face by the firm weren't as high as expected.

Step-by-step explanation:

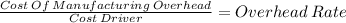

the expected overhead wil be distribute over the cost driver which, in this case, is machine hours:

840,000 / 70,000 = $12

each machine hours will generate 12 dollar of overhead

b) applied overhead:

67,000 hours x $12 overheead per hour = 804,000

c) actial overhead

Depreciation on manufacturing property,

plant, and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . 600,000

Property taxes on plant . . . . . . . . . . . . . . . . . . . . . . . . . 40,000

Plant janitor’s wages . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,000

Total ovehead 657,000

We compare with the allcoated

657,000 - 804,00 = -147,000

there is