Answer:

WIP inventory 366,014.43 debit

Manufacturing Overhead 366,014.43 credit

Step-by-step explanation:

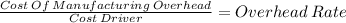

we solve first, for the manufacturing predetermined rate:

we divide the expected overhead cost with the direct labor estimated

337,100 / 47,800 = 7,052301255230126

Then we multiply this rate by the actual direct labor incurred during the period:

7,052301255230126 x 51,900 = $366.014,4351

The entry for the applied overhead will be a debit to work in progress and a credti to factory overhead