Answer:

C. $2 decrease

Step-by-step explanation:

The impact on profit, in this situation, is given by the difference in profit from selling an extra Slicer instead of a Chopper. This can be done by subtracting the contribution margin of a Slicer by the contribution margin of a Chopper.

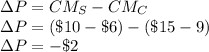

Contribution margin is the difference between the selling price and the variable manufacturing price. The impact on profit would be:

Therefore, the impact on profit if 360 units are sold but 145 Slicer models are sold instead of 144 would be a $2 decrease.