Answer:

Bowie will require saving for $1,101,832.05 to achieve their goal.

Step-by-step explanation:

He expect to have wages 800% of what he currently owns:

60,000 x 80% = 48,000

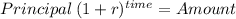

Now, this will increase 3% per year for inflation reasons:

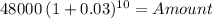

Principal 48,000.00

time 10.00

rate 0.03000

Amount 64,507.99

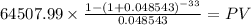

Now, we solve for the present value of an annuity of 33 year (95 - 62) with a real rate according to Irwin method of:

1.08/1.03 - 1 = 0.048543

C 64,507.99

time 33

rate 0.048543

PV $1,101,832.0536