Answer:

Value of the retirement accoutn after 20 years: $ 1,028,629.71

Step-by-step explanation:

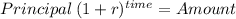

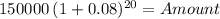

future value of the 150,000 amount rolled over:

Principal 150,000.00

time 20.00

rate 0.08000

Amount 699,143.57

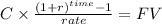

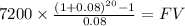

future value of a 20 years anuity of 20 year at 8% interest rate:

C 7,200.00

time 20

rate 0.08

FV $329,486.1429

Total amount after 20 years:

699,143.57 + 329,486.14 = 1,028,629.71