Missing Question Data:

The question was missing the total amount of loan taken. I have found the question online and the missing data is added below.

Step-by-step explanation:

DATA:

Car Loan = $15000

Interest Rate (annual) = 7% = 0.07

Interest Rate (monthly) = 0.07/12 = 0.00583

Loan Life = 3 years

Period (monthly) = 3*12 = 36

Investment Rate (annual) = 4% = 0.04

Investment Rate (monthly) = 0.04/12 = 0.00333

Salvage value after 3 years (PV of Salvage Value) = $5000

Lease Down Payment = $3000

Lease Monthly Payment = $350

First, we consider the option of Buying on Loan

Car Loan - Salvage Value(PV) = 15000-5000

Car Loan - Salvage Value(PV) = $10000

For the option of Leasing the Car

Sum of monthly lease payments for the total period will be,

Sum of Installments (FV) = 350 * 12 = $12600

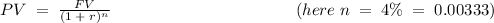

We know that,

Sum of Installments (PV) =

Sum of Installments (PV) = $11178.76

Total Lease Payment = Down Payment + Sum of Installments (PV)

Total Lease Payment = $3000 + $ 11178.76

Total Lease Payment = $14178.76

As we can see that total investment for Loan option is lower than that of Lease option, hence taking Loan is the best choice.