Answer:

B) $238,132

Step-by-step explanation:

Firstly, we calculate the effective annual rate (EAR) which can be estimated as shown below:

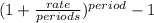

EAR =

rate = 7.80%; periods = 4 (quarterly)

EAR = (1+ 0.078/4)^4 - 1 = (1+0.0195)^4 - 1 = (1.0195)^4 - 1 = 1.08031 - 1 = 0.08031

Then,

Monthly rate = [(1+EAR)^(1/12)] - 1 = [(1+0.08031)^(1/12)] - 1 = [(1.08031)^(0.0833)] - 1 = 1.006458 - 1 = 0.006458

Thus, if we use the formula for PVA, to estimate the PV. Where I = 0.6458; N = 60 (5 years × 12 months/yr); FV = 0; PMT = $4800, the PV = $238,132.