Answer:

20.72; 4.39

Explanation:

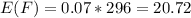

The expected number of fraudulent returns is given by the probability that a return is fraudulent multiplied by the number of returns in the sample:

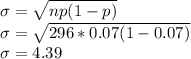

The standard deviation of this binomial probability with p =0.07 and n = 296 is:

Therefore, in a random sample of 296 independent returns from this year, around 20.72 returns, give or take 4.39, will be fraudulent or will contain errors that are purposely made to cheat the IRS.