Answer:

The best option would be the third as it the equivalent of 316,137 dollars today

Step-by-step explanation:

We calcualte the present value of the alternatives and determinate the best for Jhon (the most expensive for the company)

Option 1: 186,000

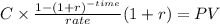

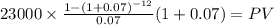

Option 2: present value of an annuity-due:

C 23,000.00

time 12

rate 0.07

PV $195,469.5098

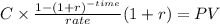

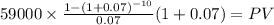

Option 3: present value of an annuity-due:

C 59,000.00

time 10

rate 0.07

PV $443,398.7027

As this beging at age 60 we should discount this amount 5 years:

Maturity $443,398.7027

time 5.00

rate 0.07000

PV 316,137.1470