Answer:

a) Proceeds $83,050,438.56

b) discount amortization(first payment)

83,050,438.56 x 0.05 = 4,152,521.93

- 90,000,000 x 0.04 = 3,600,000

amortization 552,512.93

ending carrying value

83,050,438.56 + 552,512.93 = 83,602,96

c) discount amortization(second payment)

83,602,96 x 0.05 = 4,180,148.02

less cash outlay of 3,600,000

amortization 580,148.02

d) total interest expense for the first year

4,152,521.93 June + 4,180,148.02 Dec = 8,332,669.95

Step-by-step explanation:

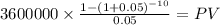

We solve for the present value of the bond by discount the coupon payment and maturity at the market rate:

C 3,600,000.000

time 10

rate 0.05

PV $27,798,245.7451

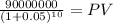

Maturity 90,000,000.00

time 10.00

rate 0.05

PV 55,252,192.82

PV c $27,798,245.7451

PV m $55,252,192.8187

Total $83,050,438.5637