Answer:

-0.0246 or -2.46%

Step-by-step explanation:

The duration 't' of his investment is:

The future value ($10,668,500) of an initial investment ($12,700,500) at a rate 'r' for a period of 7 years is given by:

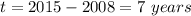

![10,668,500=12,700,500*(1+r)^7\\1+r=\sqrt[7]{(10,668,500)/(12,700,500)}\\1+r=0.9754\\r=-0.0246=-2.46\%](https://img.qammunity.org/2021/formulas/business/college/91j9njacbcmompzgw8zo5zren7gp4sz0jp.png)

His annual rate of return was -0.0246 or -2.46%.

*A negative rate of return means that money was lost in this investment