Question:

A shopper bought a watermelon, a pack of napkins, and some paper plates. In his state, there is no tax on food. The tax rate on non-food items is 5%. The total for the three items he bought was $8.25 before tax, and he paid $0.19 in tax. How much did the watermelon cost?

Answer:

Cost of watermelon is $ 4.45

Solution:

From given,

Total amount for three items before tax = $ 8.25

Tax amount = $ 0.19

Tax on non food = 5 %

Here, non food means napkin and paper plates

Let "x" be the cost spent for napkin and paper plates

Then,

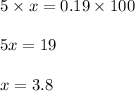

5 % = 0.19

100 % = x

This forms a proportion

Thus cost spent for napkin and paper plates is $ 3.8

Therefore,

Watermelon cost = total amount before tax - cost spent for napkin and paper plates

Watermelon cost = 8.25 - 3.8 = 4.45

Thus cost of watermelon is $ 4.45