Answer:

$ 2,209,797.96

Step-by-step explanation:

Given:

Salary = $100,000

Salary investment rate = 13%

Salary increase rate(g) = 5%

number of year = 25

Annual rate of return(i) = 11%

Calculation:

Salary invested = $100,000*13% = $13,000

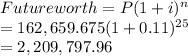

calculation of present worth

![P=A[(1-(1+g)^n(1+i)^(-n))/(i-g)] \\P=13000[(1-(1+0.05)^(25)(1+0.11)^(-25))/(0.11-0.05)] \\P=13000[(1-(1.05)^(25)(1.11)^(-25))/(0.06)] \\P=13000[(1-(3.386354)(0.073608086))/(0.06)]\\\\P=13000[(1-0.249263)/(0.06)]\\\\ P=13000[12.5122827]\\\\\\P= 162,659.675](https://img.qammunity.org/2021/formulas/business/college/qh1fji6s4yqtv115dez21nwwi3kmi2isji.png)