Answer:

The bonds were issued at $87,590,959

Step-by-step explanation:

The bonds will be issued at the present value of the coupon and maturity discounted by the market rate

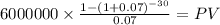

C 6,000,000.000 ( 100 million x 6%)

time 30 (2051 - 2021)

market rate 7% = 7/100 = 0.07

PV $74,454,247.1010

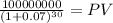

PV of the maturity

Maturity 100,000,000.00

time 30.00

rate 0.07

PV 13,136,711.72

Total current value of the bonds:

PV coupon $ 74,454,247.1010

PV maturity $ 13,136, 711.7155

Total $87,590,958.8165