Answer:

My parents will need to make 18 deposits of 24,724.16 dollars

My parent will then have to deposit 28,185.55 per year

which is $3,461.39 more than the other scenario

Step-by-step explanation:

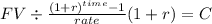

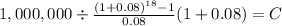

We need to solve for the future value of an annuity-due (because the payment are made at the beginning of each period

FV 1,000,000

time 18

rate 0.08

C $ 24,724.163

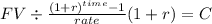

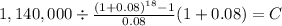

If we need do save and additional 140,000 dollars:

FV 1,140,000

time 18

rate 0.08

C $ 28,185.546

The difference will be:

28,185.55 - 24,724.16 = 3.461,39