Answer:

the value of the stock (the discount value of the free cash flow) will be $ 32.87

Step-by-step explanation:

sales are 600,000

the free cash flow is 15% of this amount

600,000 x 15% = $90,000

This will grow at 8% during three years

and then indefinitely at 3%

We will use the gordon model to solve for the value a single share:

First we calculate the cashflow:

90,000 x 1.08 = 97,200

97,200 x 1.08 = 104,976

104,976 x 1.08 = 113,374.08

113,374.08 x 1.03 = 116,775.30

Then, we discount as the present value of a lump sum.

The 5th year will used to calculate the present value of all the future cash flow:

113,775.30/ (0.14-0.03)

and then discounted.

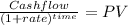

![\left[\begin{array}{ccc}Year&cashflow&PV\\1&90,000&78,947.3684\\2&97,200&74,792.2438\\3&104,976&70,855.8099\\4&113,374.08&67,126.5567\\4&116,775.3024&628,548.6676\\&TOTAL&920,270.6464\\\end{array}\right]](https://img.qammunity.org/2021/formulas/business/college/xqehddqa83wptray0fnfbdyi0wt3347rsn.png)

Then, we divide by the number of shares to get the value of a share:

920,270.65 / 28,000 shares outstanding = 32,8668 = $ 32.87