Answer:

C. Quick Ratio = 0.38

Step-by-step explanation:

We know,

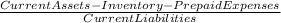

Quick Ratio =

Quick ratio means how quickly a company can pay its current debt with its quick assets.

Given,

Current Assets = Cash + Accounts Receivable + Inventory + Prepaid Insurance

Current Assets = $(5,000 + 15,000 + 40,000 + 3,000) = $63,000

Current Liabilities = Accounts Payable + Notes Payable in 5 Months + Salary Payable

Current Liabilities = $(15,000 + 12,500 + 25,000) = $52,500

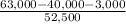

Putting the value in the formula,

Quick Ratio =

Quick Ratio = $(20,000 ÷ 52,500)

Quick Ratio = 0.38 : 1

Therefore, the quick ratio is 0.38, and the option is "C"