Answer:

Part a: The Future value of the annuity after 40 years is $518113.24.

Part b: The per year withdrawal in retirement for 25 years will be $48536.19.

Explanation:

As the numbers are appearing as a duplication taking all these values as single.

Part a

Future value is given as

![FV=PMT * [\frac{{(1+I)}^(N)-1}{I}]](https://img.qammunity.org/2021/formulas/mathematics/college/5prl4al3o9knr7h1osdqv0fsb85e7bc2ig.png)

Here

- PMT is the annual value which is $2000 per year

- I is the interest rate which is given as 8%

- N is 40

![FV=PMT * [\frac{{(1+I)}^(N)-1}{I}]\\\\FV=2000 * [\frac{({1+.08})^(40)-1}{.08}]\\FV=\$ 518113.03](https://img.qammunity.org/2021/formulas/mathematics/college/zeaa7e8oprg99fttg3c2ih2suigllt69kg.png)

So the Future value of the annuity after 40 years is $518113.24.

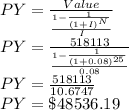

Part b

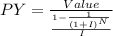

Per year withdrawal is given as

Here

- PY is the per year withdrawal

- Value is the total amount which is $ 518113 as calculated in part a

- I is the rate of interest which is 8%

- N is 25 years as expected life to live in retirement.

So the value is given as

So the per year withdrawal in retirement for 25 years will be $48536.