Answer:

5%

Step-by-step explanation:

Data provided in the question:

Present value of the company, PV = $300,000

Current Profits, π₀ = $11,000

Interest rate, i = 9% = 0.09

Now,

we know,

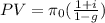

here,

g is the growth rate

on rearranging, we get

g =

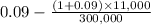

on substituting the respective values, we get

g =

or

g = 0.05

or

g = 0.05 × 100%

= 5%