Answer:

The bond were issued at 641,657.81

issuance entry:

cash 641,657.81 debit

discount on BP 158,341.19 debit

bonds payable 850,000 credit

first interest payment entry:

interest expense 25,666.31 debit

cash 24,000 credit

discount on PB 1,666.31 credit

Step-by-step explanation:

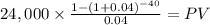

The bond will be issued at the present value of coupon payment and maturity discounted at market rate:

C 24.000 (800,000 x 6%/2)

time 40 (20 years x 2)

rate 0.04 (market rate 8% / 2)

PV $475,026.5732

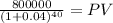

Maturity 800,000.00

time 40.00

rate 0.04

PV 166,631.24

PV c $475,026.5732

PV m $166,631.2357

Total $641,657.8089

Then, it willalcualte interest expense and amortization as follows:

interest expense

641,657.81 x 0.04 = 25,666.31

cash outlay (24,000)

amortization 1,666.31

(this will decrease the value of the discount on BP accounts.)