Answer:

equipment 65,000 debit

lease liability 65,000 credit

--to record machine under lease agreement---

interest expense 6,610.5 debit

lease liability 6,610.5 credit

-- to record accrued interest--

lease liability 15,000 debit

cash 15,000 credit

Step-by-step explanation:

a) we record considering the present value of the future payment

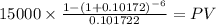

b) we determinate the discount rate using excel goal seek tool:

C 15,000.00

time 6

rate 0.101724917 = 10.17%

PV $65,000.0000

c) at year end we calculate the interest generated for the liability and declare the interest expense

65,000 x 10.17% = 6,610.5

d)Then, we record the payment which decreases the liability.