Answer:

Option C)

Explanation:

We are given the following in the question:

I is the annual income of a person in a country R

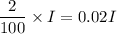

2 percent of one’s annual income =

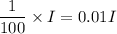

1 percent of one’s annual income =

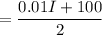

Average of 100 units of Country R’s currency and 1 percent of one’s annual income.

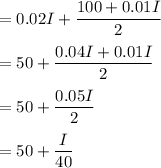

Income tax =

2 percent of one’s annual income + Average of 100 units of Country R’s currency and 1 percent of one’s annual income.

Thus, income tax is given by

Option C)