Answer:

The depreciation expense for 2020 is $21398.32.

Step-by-step explanation:

Given information:

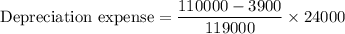

Cost of truck = $110000

Salvage value = $3900

Useful life = 119000 miles

Miles driven in 2020 = 24000

Miles driven in 2021 = 32000

We need to find the depreciation expense for 2020

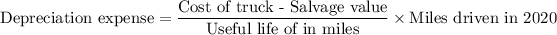

The formula for depreciation expense is

Therefore, the depreciation expense for 2020 is $21398.32.