Answer:

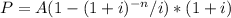

C) $96,236.09

Step-by-step explanation:

To solve this problem, we will use the Present Value of an annuity due formula. The annuity is due because the withdrawals are made at the beginning of each period.

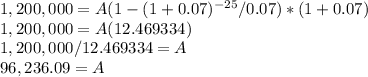

The formula is:

Where:

P = Present value of the annuity

A = Value of each annuity payment

i = Interest rate

n = number of periods

Now, we simply plug the amounts into the formula: