Answer:

Coupon rate = 7.14 %

yield to maturity = 7 %

correct answer is С. 7%

Step-by-step explanation:

given data

face value = $1400

annual coupon = $100

par value of $1000

annual coupon = $75

today price = $1004.50

solution

we get here first coupon rate that is

Coupon rate =

...........1

...........1

Coupon rate =

Coupon rate = 7.14 %

and

we get here yield to maturity that is

yield to maturity = [ annual coupon + ( par value - today price ) ] ÷ today price ...................2

put here value

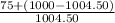

yield to maturity =

yield to maturity = 0.070184 = 7 %

so correct answer is С. 7%