Answer:

Merchandise inventory 20,388.82 debit

Note payable 20,388.82 credit

Step-by-step explanation:

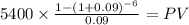

First we calculate the present value of the annuity at 9% discount rate

C 5,400.00

time 6

rate 0.09

PV $26,404.1168

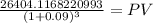

Then, we discount this value by the three year grace period between the purchase and the first payment

Maturity 26,404.12

time 3.00

rate 0.09000

PV 20,388.8228