Answer:

b) 0.0007

c) 0.4163

d) 0.2375

Explanation:

We are given the following:

We treat securities lose value as a success.

P(Security lose value) = 70% = 0.7

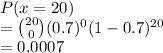

Then the securities lose value follows a binomial distribution, where

where n is the total number of observations, x is the number of success, p is the probability of success.

Now, we are given n = 20.

a) Assumptions

- There are 20 independent trials.

- Each trial have two possible outcome: security loose value or security does not lose value.

- The probability for success of each trial is same, p = 0.7

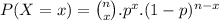

b) P(all 20 securities lose value)

We have to evaluate:

0.0007 is the probability that all 20 securities lose value.

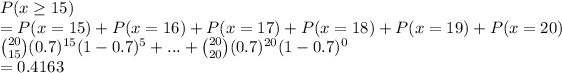

c) P(at least 15 of them lose value.)

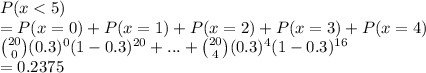

d) P(less than 5 of them gain value.)

P(gain value) = 1 - 0.7 = 0.3