Answer:

Hi there!

Break-even volume: 30,986 clippings per year

Step-by-step explanation:

What you need to do first is to calculate the contribution margin (CM) wich represents the portion of sales revenue that is not consumed by variable costs and so contributes to the coverage of fixed costs. Is calculated as selling price (P) per unit minus the variable cost (V) per unit.

CM = P - V

CM = 5.7 - 2.15

CM = 3.55

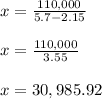

You can now calculate the break-even point as

TFC is Total Fixed Costs,

P is Unit Sale Price, and

V is Unit Variable Cost.

x ≅ 30,986