Answer:

Part 1:

Part 2:

Step-by-step explanation:

Part 1: (the book value per share of the preferred and common stock under No preferred dividends are in arrears)

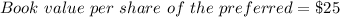

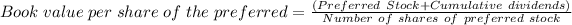

Book value per share of the preferred :

In our case Cumulative dividends=0

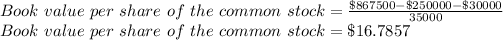

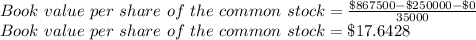

Book value per share of the common stock:

In our case Cumulative dividends=0

In our case Cumulative dividends=0

Part 2:

Annual Preferred Dividend=4%*$25*10,000=$10,000

Three years of preferred dividends are in arrears= 3*Annual Preferred Dividend

Three years of preferred dividends are in arrears= 3*$10000=$30,000

Formula for the book value per share of the preferred is same as above,so we will direct calculate:

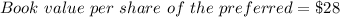

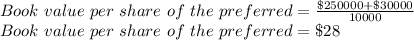

In our case Cumulative dividends=$30,000

Book value per share of the preferred :

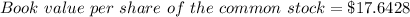

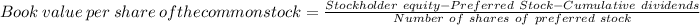

Book value per share of the common stock:

Formula for the book value per share of the common stock is same as above,so we will direct calculate: