Answer:

Creditors expected claim is $37,800

Step-by-step explanation:

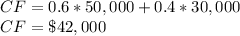

If operation cash flows are enough to pay off the debt, then creditors are expected to claim the whole debt amount while shareholders will claim the residual value. The expected cash flow from operations is:

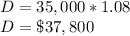

The debt value next year at an 8% interest rate is:

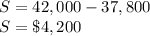

Since Cash flows exceed debt, creditors are expected to claim $37,800

While Shareholders are expected to claim:

The correct answer is: Creditors expected claim is $37,800.