Answer:

We can withdraw an equivalent annuity of $ 293.658 each year.

Step-by-step explanation:

We build a scheduled table to know the future value of the gradient investment

Time Beg Gradient Total Rate Ending

1 $100.00 $100.00 $100.00 0.060 $106.00

2 $106.00 $100.00 $206.00 0.060 $218.36

3 $218.36 $200.00 $418.36 0.060 $443.46

4 $443.46 $300.00 $743.46 0.060 $788.07

5 $788.07 $400.00 $1,188.07 0.060 $1,259.36

6 $1,259.36 $500.00 $1,759.36 0.060 $1,864.92

7 $1,864.92 $600.00 $2,464.92 0.060 $2,612.81

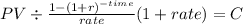

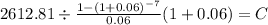

Then, we solve for the equivalent annuity-due:

PV 2,613

time 7

rate 0.06

C $ 293.658

Itis annuity due as we will going to retire cash in a 6 year period for seven times. (at each year-end during 6 years thus, annuity-due

1st 2nd 3rd 4th 5th 6th 7th

/-------/-------/-------/-------/-------/-------/-------/

1 2 3 4 5 6 7