Answer:

$600

Explanation:

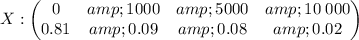

Let the random variable

denote the damage in $ incurred in a certain type of accident during a given year. The probability distribution of

denote the damage in $ incurred in a certain type of accident during a given year. The probability distribution of

is given by

is given by

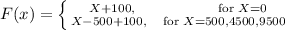

A company offers a $500 deductible policy and it wishes its expected profit to be $100. The premium function is given by

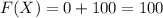

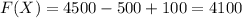

For

, we have

, we have

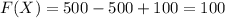

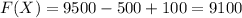

For

,

,

For

,

,

For

,

,

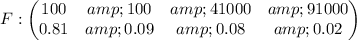

Therefore, the probability distribution of

is given by

is given by

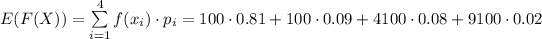

To determine the premium amount that the company should charge, we need to calculate the expected value of

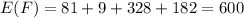

Therefore,

which means the $600 is the amount the should be charged.