Answer:

$66.9725

Step-by-step explanation:

Data provided in the question:

Dividend:

D1 = $1.20

D2 = $1.40

D3 = $1.55

Expected future price, P3 = $82

Required return = 8.9 percent = 0.089

Now,

Stock price today = Present value of dividends and the future value

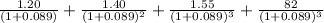

Stock price today =

or

Stock price today = 1.1019 + 1.1805 + 1.2001 + 63.49

or

Stock price today = $66.9725