Answer:

so correct answer is d. 42.93

Step-by-step explanation:

given data

pay a dividend 1 year D1 = $2.41

pay a dividend 2 year D2 = $2.56

sales in 2 years expected = $15,450,000

price/ sale PS ratio = 1.59

shares outstanding = 521500

company stock r = 10.4 percent

solution

first we get here sales per share will be

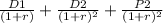

sales per share =

sales per share = 29.63

so here P2 is = sales per share × PS ratio

P2 = 29.63 × 1.59

P2 = 47.11

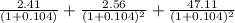

so here current stock price will be

current stock price =

...................1

...................1

put here value we get

current stock price =

current stock price = 42.93

so correct answer is d. 42.93