For the given problem, Profit Margin = 1.88%, Liabilities-to-assets ratio = 40% and debt-to-assets ratio = 20%.

Step-by-step explanation:

From the given data,

Sales/total assets=1.6 ,

Return on assets (ROA)=3% ,

Return on equity (ROE)=5%.

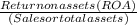

1) To calculate Profit Margin,

Profit Margin =

.

.

Profit Margin =

.

.

Profit Margin = 1.88%.

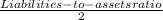

2) To calculate Liabilities-to-assets ratio,

Liabilities-to-assets ratio =

.

.

Liabilities-to-assets ratio =

.

.

Liabilities-to-assets ratio = 1 - 0.6.

Liabilities-to-assets ratio = 40%.

3) The debt-to-assets ratio,

The half of the Liabilities-to-assets are in form of debt.

The debt-to-assets ratio =

∴ The debt-to-assets ratio = 20%.