Answer:

31%

Step-by-step explanation:

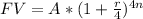

The equation that describes the future value of a lump sum (A) invested for 'n' years at an annual rate 'r' compounded quarterly is:

If Thomas invested $1,000 for 6 years and wants $5,000, the interest rate must be:

![6,000 = 1,000*(1+(r)/(4))^(4*6)\\6 = (1+(r)/(4))^(24)\\r=4*(\sqrt[24]{6}-1)\\r=0.31 = 31\%](https://img.qammunity.org/2021/formulas/business/college/28lwr9yqvc0mslz2scxgbcg9gpnvwtl971.png)

He needs a 31% interest rate.